Ad Code

Translate

List of 6,000+ Dofollow Commentluv Blogs FREE (Updated 2025)

January 16, 2025

What is Ozempic (semaglutide)? (Updated in 2025)

January 30, 2025

How To Find Suitable Properties In Cyprus? (Updated in 2025)

January 11, 2025

Smart strategies for trading on crypto exchanges

April 23, 2025

10 Tax Deductions You Didn't Know You Should Be Taking

Khabza Mkhize

March 26, 2024

No one enjoys paying taxes, but everyone loves saving money. Thankfully, the IRS helps taxpayers offset their financial burden by offering generous deductions that lower one’s overall tax liability—so you can keep more of your hard-earned money in your pocket, where it belongs.

Many Americans are unaware of these tax-saving opportunities, and as a result, they end up paying the federal government more than necessary. The good news is that you don’t need to become a professional accountant to find tax-savings loopholes—you just need to know where to look.

Today, we’re sharing 10 tax deductions that you should claim on your next return, but before we dive into money-saving details, there are a couple of notes worth mentioning…

Tax deductions are different from tax credits. The former reduces your overall taxable income, while the latter reduces your tax bill dollar-for-dollar.

The IRS offers a standardized deduction, or a set dollar amount that you can claim (depending on your filing status) with “no questions asked”. However, you also have the option to claim itemized deductions or line-item expenses that deduct your taxable income, which may make more sense for self-employed individuals or those with numerous, significant expenses.

The Tax Cuts and Jobs Act (TCJA) no longer limits the amount of itemized deductions you can claim, but keep in mind that you’ll need to save proof of these purchases to provide evidentiary support in the event of an IRS audit. Remember this during your tax prep checklist as you gather all necessary documents.

You must meet specific eligibility criteria to claim the deductions suggested below. Claiming false deductions could be considered fraud and may land you in serious back tax debt, so research before filing them on your return.

Here are 10 tax deductions you might not be aware of that could help you save money on your next return.

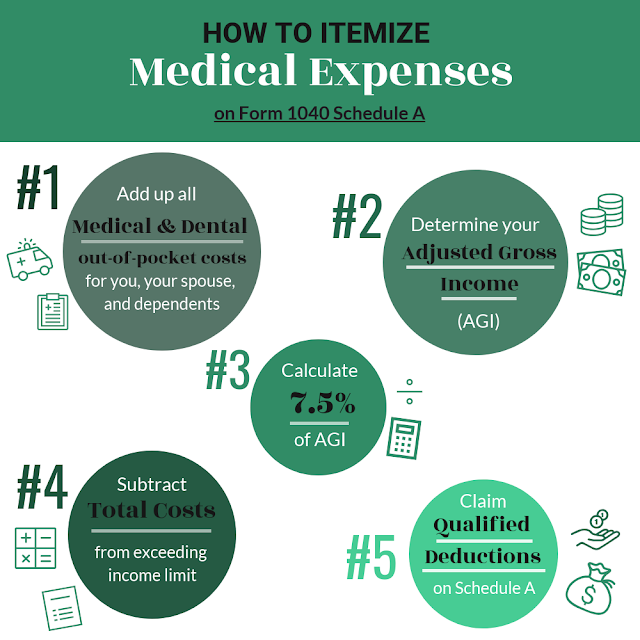

Medical & Dental Expenses

If you or your family incurred significant medical bills within a given tax year, the IRS allows you to deduct a particular portion of qualified expenses from your taxable income. Some examples you may itemize include dental treatments, eye exams, hospital fees, prescription medications, etc.

However, you can only deduct the portion of expenses that exceeds 7.5% of your adjusted gross income (AGI). For example, if your AGI was $60,000, and your qualified expenditures amounted to $7,000, you could deduct $2,500 [$60,000 x 0.075 = $4,500; $7,000 – 4,500 = $2,500].

Home Mortgage Insurance

If you own a home, you can deduct the interest you paid on the mortgage (unfortunately, not the total debt); the amount you paid per year will be displayed on Form 1098 provided by your mortgage company.

For home loans taken out after December 15, 2017, the interest tax deduction is limited to debt amounting to $750,000 if you’re filing as Single, Married Filing Jointly/Widower, or Head of Household. If you are Married and Filing Separately, the debt limit is $375,000. In Tax Year 2026, the cap extends to interest paid on all mortgages $1,000,000 or lower.

Property Taxes

Homeowners can also deduct the property taxes paid when they live in the home—rental and commercial properties do not qualify. State and local agencies assess annual property taxes based on the real estate's value. Taxpayers can deduct up to $10,000 in State and Local Taxes (SALT), including property, income, and sales taxes.

Charitable Deductions

You can save money by doing good, as charity donations are deductible on your tax return. For donations worth more than $5,000, the IRS will request a qualified appraisal of the item included with your return.

Work-Related Expenses

One of the best—and underutilized—ways to save money on taxes is with work-related expenses. According to Forbes, the average freelancer loses $5,000 worth of unclaimed tax deductions on an income of $50,000, but anyone can deduct unreimbursed work expenses. Below are some of the most common ways taxpayers leave money on the table.

- You may qualify for the home office deduction if you work at home. Office supplies, hardware, and software are also deductible.

- Self-employed individuals can deduct business-related gas mileage, which rate is set at $0.58 per mile and can add up quickly if carefully tracked.

- Education and certification programs may be deductible, but they are pending. They directly relate to your line of work, so keep track of your tuition costs.

- Those who pay for their own health insurance can deduct the cost of annual premiums. Freelancers may also deduct business insurance, such as liability or contractor coverage.

- If you use your cell phone for business, you can deduct a portion of your bill on Form 1099. The same applies to your internet provider.

These are just a few examples of work-related deductions. Travel expenses are also ordinary, as are those related to moving for a job relocation.

Student Loan Interest

Repaying student loan debt can reduce taxable income by up to $2,500 for the amount paid in interest. This is considered an above-the-line deduction, meaning you do not need to itemize deductions to claim it. However, it’s only available for students enrolled at least half-time at an eligible education institution, and the deduction phases out for AGIs over $60,000 as of 2019.

Retirement Contributions

Setting aside retirement savings will help you in the future and the present since contributions made to specific retirement plans such as 401(k)s and IRAs can be deducted from the tax return in the year they were made.

Childcare Costs

Although you can’t write off all childcare expenses, the IRS offers families several tax credits to help offset the costs of babysitters: the child tax credit, the child and dependent care credit, and the earned income tax credit. The best filing option for your circumstances will depend on your income level and eligibility criteria.

Casualty and Theft Loss

Hopefully, this doesn’t apply to your situation. Still, you can deduct casualty and theft losses related to your home, household items, and vehicles if the loss is due to a federally declared disaster.

Tax Preparation Fees

Preparing a tax return can be highly complex, so many people choose to hire a professional who can file on their behalf—and why not if the cost is deductible? The IRS offers this tax deduction for landlords (Schedule E), sole proprietors (Schedule C), and farmers (Schedule F), but anyone can claim it as a “miscellaneous” itemized deduction on line 22 of Schedule A. Note that you can only deduct miscellaneous items that exceed 2% of your AGI.

Conclusion

Tally up your itemized deductions, and if it’s higher than the standardized amount, use this filing strategy to save more on your tax return. Remember to keep proof of all your receipts should the IRS spot any red flags and issue an audit.

Sources

Author Bio:

Kaelee Nelson received her Master's degree with an emphasis in Digital Humanities and pursues her career as a writer in San Diego, currently writing for 365businesstips.com. She enjoys informing readers about topics spanning industries such as technology, business, finance, culture, wellness, hospitality, and tourism.

Featured Post

12 Prominent new technologies and trends emerging in 2025

Khabza Mkhize-

April 02, 2025

Soapie Teasers

Sister Sites

Most Popular

List of 6,000+ Dofollow Commentluv Blogs FREE (Updated 2025)

January 16, 2025

Smart strategies for trading on crypto exchanges

April 23, 2025

Popular posts

List of 6,000+ Dofollow Commentluv Blogs FREE (Updated 2025)

January 16, 2025

Smart strategies for trading on crypto exchanges

April 23, 2025

Footer Menu Widget

Created By Blogspot Theme | Distributed By Gooyaabi Templates

0 Comments